Zynga

Video game giant Take-Two is acquiring mobile gaming company Zynga in a cash-and-stock deal that the company says will turn the Grand Theft Auto maker into a mobile gaming powerhouse. The deal is valued at around $12.7 billion, or $9.86 per Zynga share.

Take-Two Chief Executive Strauss Zelnick said the deal will benefit both companies, giving Zynga access to the best-selling game franchises Take-Two is known for, while also giving Take-Two access to player analytics, advertising and mobile game making technology that so far it’s lacked. “What we’ve found is that great entertainment wins,” he said in an interview Monday. “It’s really hard to build organically.”

Get the CNET Now newsletter

Spice up your small talk with the latest tech news, products and reviews. Delivered on weekdays.

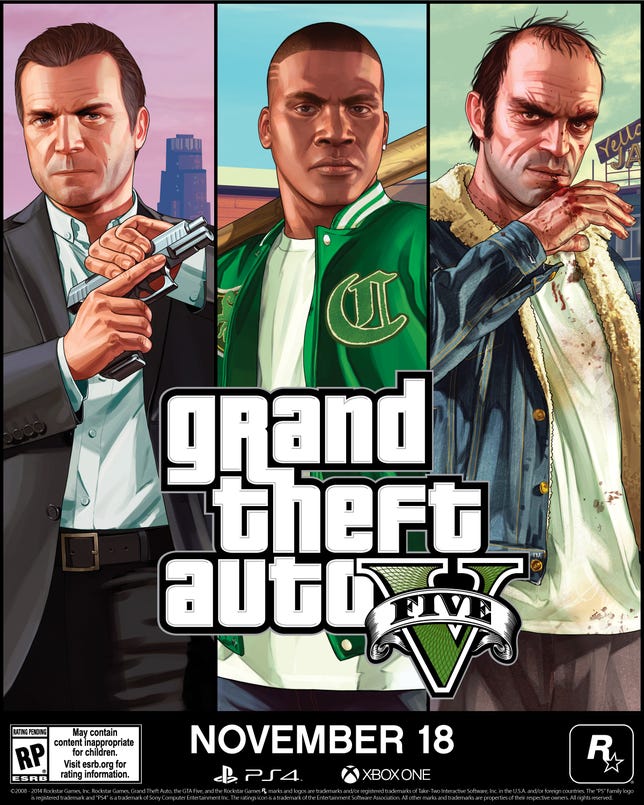

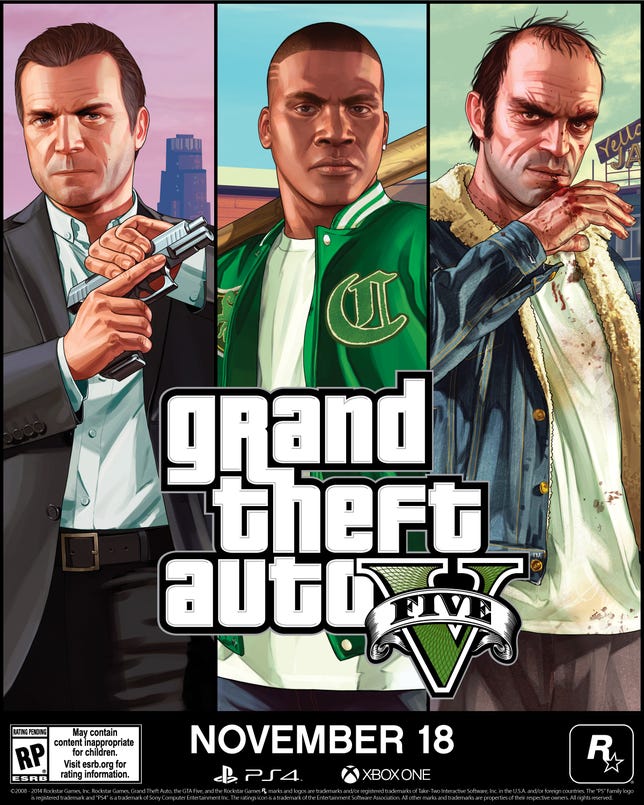

Zynga publishes major social games like FarmVille and Words With Friends. Take-Two already owns game publishers Rockstar, which is behind Grand Theft Auto and Red Dead Redemption, and 2K, known for BioShock, Borderlands, Civilization and NBA 2K.

Take-Two’s Grand Theft Auto V, from 2013, is one of the best selling games of all time.

Rockstar Games

Zelnick declined to discuss details of future plans, noting the deal doesn’t close until midyear, but he did say a key opportunity for both companies is in what the industry calls cross-play, where people can play part of or the same full titles on a phone or an video game console or PC. Titles like Epic Games’ Fortnite and Activision Blizzard’s Call of Duty Warfare have significantly grown in popularity in part because of this feature.

“Ultimately the consumer votes,” Zelnick said.

The move marks the latest instance of a large game maker acquiring companies with mobile and social networking expertise to help expand their lineup. Activision Blizzard bought Candy Crush maker King in 2015 for about $6 billion, and Electronic Arts has paid nearly $5 billion over the past decade to buy a string of social, mobile and casual-focused gaming companies including Playdemic, Glu Mobile and Plants vs. Zombies maker PopCap Games.

The acquisition also underscores the challenges both companies are facing in the changing entertainment industry. Take-Two has often turned to outside developers to help make games work on mobile devices, with mixed success. Meanwhile, Zynga’s been recently hit by a one-two punch of easing pandemic restrictions, which have left people with less time to play games, and Apple’s changes to marketing technology, which have made it harder to track users for targeted ads.

Aside from combining two companies with different capabilities, Zelnick said the Zynga acquisition will also help as Take-Two evaluates emerging Web3 technologies, including NFTs and cryptocurrency.

“As long as we’re enhancing the overall entertainment experience, it’s potentially exciting,” Zelnick added.