Traders work on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., January 10, 2022. REUTERS/Brendan McDermid

Register now for FREE unlimited access to Reuters.com

Register

- World stocks stumble as more aggressive Fed tightening eyed

- U.S. 10-year Treasury yield touches 1.8%

- Dollar stuck in range despite rising yields

- Traders prepare for U.S. inflation data, company earnings

NEW YORK, Jan 10 (Reuters) – U.S. stocks fell on Monday despite staging a comeback late in the day, as bets that the U.S. Federal Reserve could raise interest rates as soon as March led investors to pare risky assets and lifted the 10-year Treasury yield to a two-year high.

Monday’s drop follows a bruising first week of the year when a strong signal from the Fed that it would tighten policy faster to tackle inflation and then data showing a strong U.S. labor market, unnerved investors who had pushed equities to record highs over the holiday period.

The Dow Jones Industrial Average (.DJI) shed 0.45%, and the S&P 500 (.SPX) lost 0.14%.

Register now for FREE unlimited access to Reuters.com

Register

Technology stocks, which have soared in the past two years thanks in part to very low interest rates, led the falls early in the day but rallied later in the session to leave the Nasdaq Composite (.IXIC) up just 0.05%.

The pan-European STOXX 600 index (.STOXX) lost 1.48% and MSCI’s gauge of stocks across the globe (.MIWD00000PUS) shed 0.26%.

“The big story of the first week of the new year has been the steady march higher in U.S. treasury yields,” said Arthur Hogan, chief market strategist at National Holdings Corp.

Hogan recommended investors put more money in financial, industrial and energy stocks as they will likely benefit from strong economic growth expected in the months ahead.

Some of Wall Street’s biggest banks now expect the Federal Reserve to raise interest rates four times this year, and Goldman Sachs (GS.N) sees the Fed beginning the process of reducing its balance sheet size as soon as July.

A busy week sees U.S. inflation data due on Wednesday, which analysts say could show core inflation climbing to its highest in decades at 5.4%, a level that would all but confirm a U.S. rate rise is coming in March. The season of corporate earnings also kicks off this week with the big U.S. banks reporting from Friday onwards. [

Rate futures now imply a greater than 70% chance of a rise to 0.25% in March and at least two more hikes by year end.

FURTHER TO RUN?

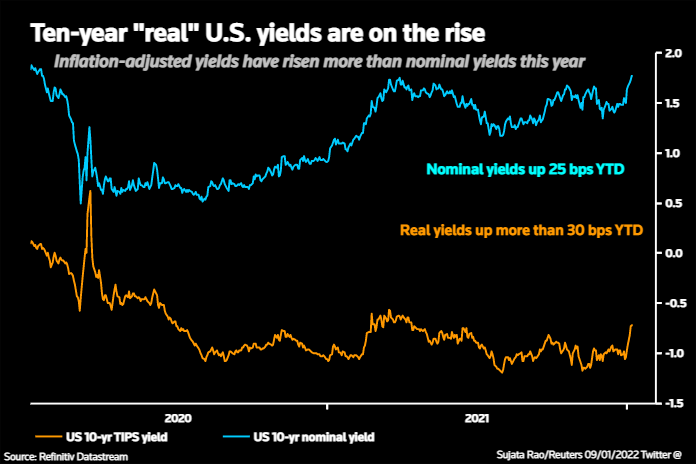

Yields on 10-year U.S. Treasury notes hit a high of 1.8080% in early trading, levels last seen in January 2020, having shot up 25 basis points last week in their biggest move since late 2019. U/S The yield later retreated to 1.7603%.

“We think that the increase in long-dated Treasury yields has further to run,” said Nicholas Farr, an economist at Capital Economics.

“Markets may still be underestimating how far the federal funds rate will rise in the next few years, so our forecast is for the 10-year yield to rise by around another 50bp, to 2.25%, by the end of 2023.”

The dollar index edged up 0.17% to 95.957 . The greenback has failed to find significant support from rising Treasury yields.

The euro stood at $1.13270 , down 0.28% on the day.

Oil prices dipped but held onto to recent gains, having climbed 5% last week helped in part by supply disruptions from the unrest in Kazakhstan and outages in Libya.

U.S. crude fell 0.85% to $78.23 per barrel and Brent closed at $80.87, down 1.1% on the day.

The shift from risk weighed on cryptocurrencies, and bitcoin last fell 0.21% to $41,788.27

Register now for FREE unlimited access to Reuters.com

Register

Reporting by By Koh Gui Qing;

Additional reporting by Wayne Cole in Sydney, Editing by Alison Williams and Lisa Shumaker

Our Standards: The Thomson Reuters Trust Principles.